Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Form is the physical shape and structure of an object or artwork. It can refer to the size, shape, texture, color, and other visual elements of an artwork. Form is one of the basic elements of art, along with line, shape, texture, value, color, and space.

When is the deadline to file form in 2023?

The deadline to file taxes for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of form?

The penalty for not filing a tax return on time is 5% of the unpaid taxes for each month the return is late, up to a maximum of 25%. In addition, if the return is more than 60 days late, the minimum penalty is the smaller of $135 or 100% of the unpaid taxes.

Who is required to file form?

It is not clear from the question which specific form is being referred to. The requirement to file a form depends on the context and the specific form being mentioned. Can you please specify the form you are referring to?

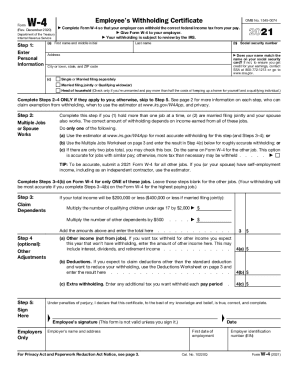

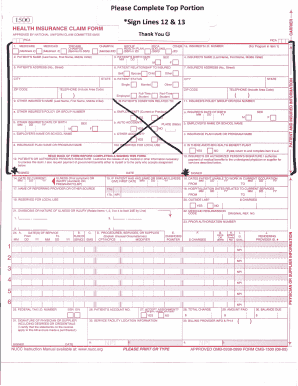

To fill out a form, follow these steps:

1. Read the form instructions: Understand what information the form requires and any specific instructions mentioned.

2. Gather necessary information: Collect all the required information beforehand, such as full name, address, phone number, email, and any other relevant details. It may be helpful to have supporting documents readily available if needed.

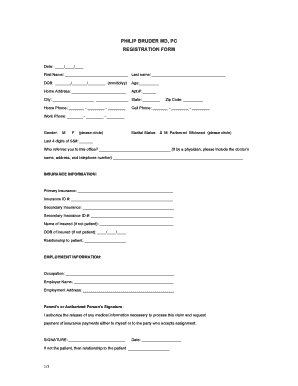

3. Start with personal information: Begin by filling in personal details like your full name, date of birth, address, contact information, and social security number, if applicable.

4. Complete required sections: Move on to sections in the form that are relevant to you. This could be educational background, employment history, medical information, or anything else depending on the purpose of the form.

5. Be accurate and thorough: Ensure the information provided is accurate, legible, and complete. Triple-check spellings, especially names and addresses.

6. Check for signature and date: Some forms may require a signature and date to validate the document. If needed, sign and date the form as instructed.

7. Review and proofread: Before submitting the form, carefully review all the information filled out. Verify that everything is correct and consistent throughout the form.

8. Attach supporting documents (if necessary): If there are any supporting documents required, ensure they are appropriately attached or provided along with the completed form.

9. Make a copy: Create a photocopy or take a clear picture of the filled-out form for your records, especially if it's an important document.

10. Submit the form: Depending on the specific submission instructions mentioned, submit the form online, mail it, or personally deliver it to the intended recipient.

Remember to always follow the instructions provided with the form and seek assistance if you have any doubts or questions.

What is the purpose of form?

The purpose of a form is to gather information or input from individuals in a structured and organized manner. Forms can be physical documents or digital interfaces that typically contain fields or sections to be filled out with specific details. The collected information can be used for various purposes, such as data collection, record keeping, registration, surveys, feedback, application processes, or any other instance where structured information is needed. Forms help streamline and standardize the collection of information, making it easier to manage and analyze the data received.

What information must be reported on form?

The information that must be reported on a form will vary depending on the purpose and type of form. However, some common information that may be required on forms includes:

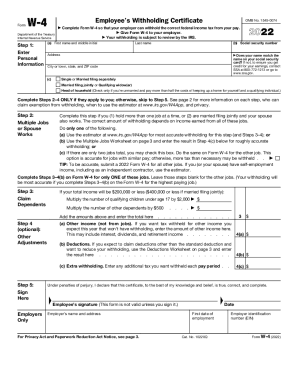

1. Personal information: Full name, contact details (address, phone number, email), date of birth, and social security number.

2. Employment information: Current and previous employment history, including employer names, addresses, job titles, dates of employment, and salary details.

3. Financial information: Income details, such as annual salary or wages, sources of income, and financial assets and liabilities.

4. Tax information: Tax identification number (e.g., Social Security Number, Employer Identification Number), details of income tax withheld, and any applicable deductions or credits.

5. Health information: Medical history, current medications, allergies, and other relevant health-related details.

6. Legal information: Any legal matters, such as criminal convictions or pending lawsuits.

7. Educational information: Academic qualifications, degrees, certifications, and relevant educational background.

8. Relationship information: Marital status, dependents, and information about spouse or children.

9. Identification: Providing copies of identification documents, such as a driver's license or passport.

It is important to note that the specific requirements for information on a form will vary depending on its purpose, such as tax forms, job applications, health forms, government forms, and so on.

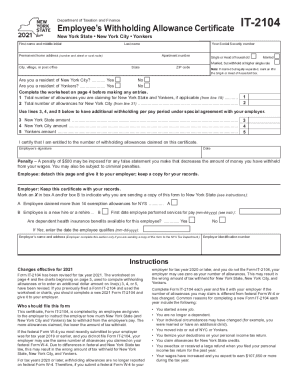

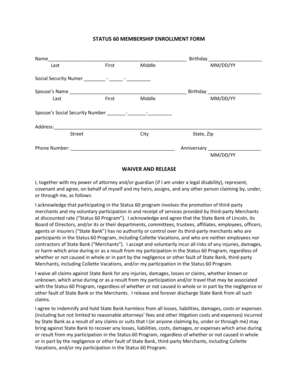

How can I send it2104 to be eSigned by others?

it 2104 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in it 2104 2024?

With pdfFiller, it's easy to make changes. Open your nys in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete it 2104 form 2024 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your new york form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.